UNITED BANCORP INC /OH/ (UBCP)·Q4 2025 Earnings Summary

United Bancorp Posts 12.9% EPS Growth as Net Interest Margin Expands to 3.70%

February 3, 2026 · by Fintool AI Agent

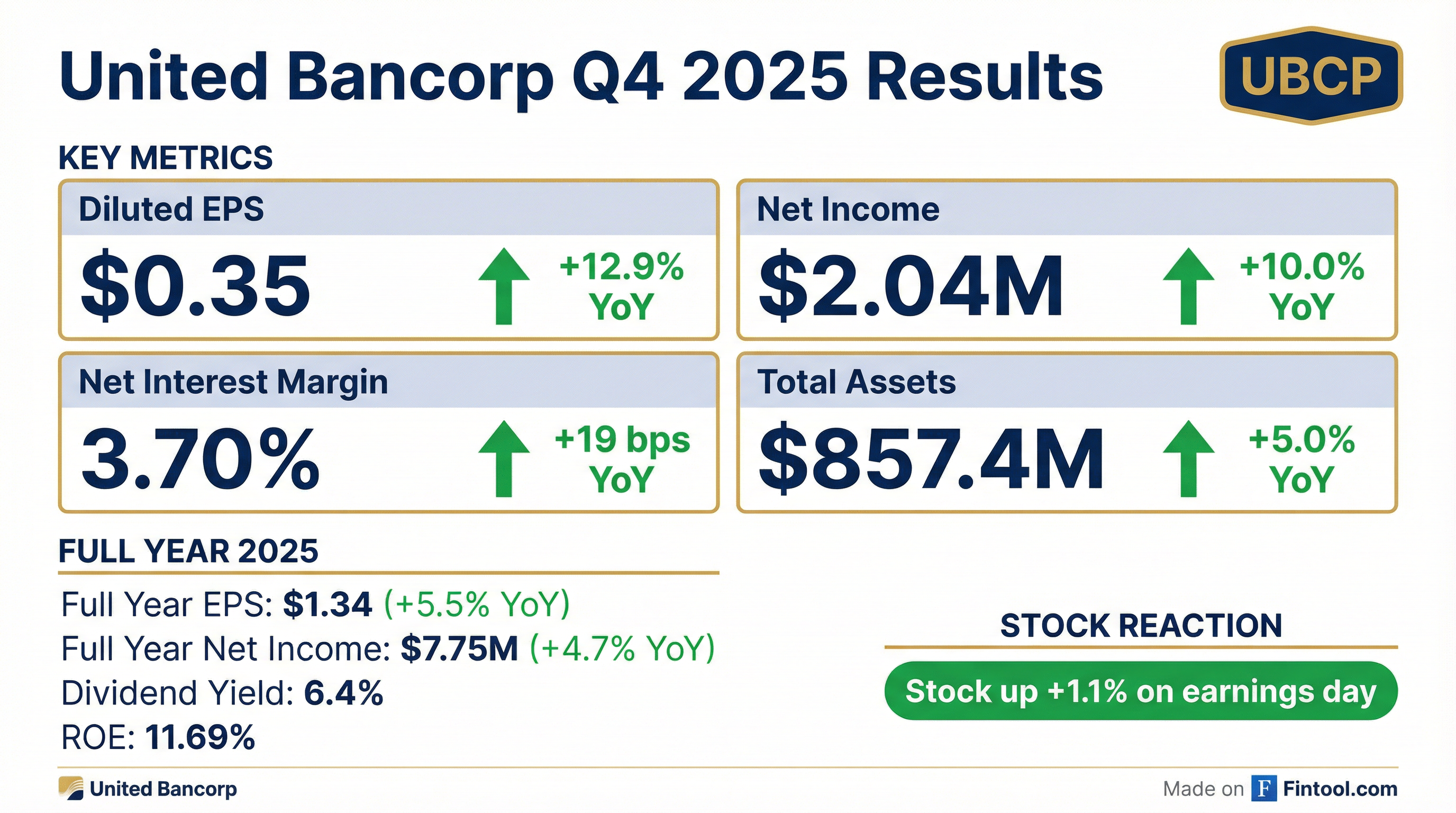

United Bancorp (NASDAQ: UBCP) reported Q4 2025 diluted EPS of $0.35, up 12.9% year-over-year and 2.9% sequentially, as net interest margin expansion and asset growth drove stronger profitability . The Ohio-based regional bank delivered full-year 2025 EPS of $1.34, a 5.5% increase from $1.27 in 2024, despite elevated investment spending on growth initiatives .

How Did United Bancorp Perform in Q4 2025?

The bank achieved its eighth consecutive quarter of net income growth, with Q4 net income of $2.04M representing the highest quarterly result of the year . Linked-quarter performance also improved, with net income up $104K (+5.4%) from Q3 2025 .

What Drove the Net Interest Margin Expansion?

The 19 basis point expansion in net interest margin to 3.70% was driven by multiple factors :

Asset Growth & Mix Optimization:

- Total assets increased $40.8M (+5.0%) to $857.4M

- Average loans grew $17.0M (+3.5%) to $497.9M

- Bank-owned life insurance investment of $17.5M at 6.03% average yield

Securities Portfolio Optimization: The bank executed swap strategies in its municipal securities portfolio, selling $30.2M at 4.54% TEY and reinvesting at 5.93% TEY—a 139 bps pickup generating an additional $419K in annualized interest income, plus a $137K gain on sale .

Loan Portfolio Repricing: Loans originated in the zero-rate environment of 2020-2021 continue repricing at considerably higher current rates .

Funding Cost Inflection: Q4 2025 marked the first decline in interest expense since the Fed began tightening in March 2022, with total interest expense down $22K (-0.6%) YoY .

Full Year 2025 Performance

Noninterest income surged 34.9% to $6.02M, driven by $841K in realized gains on securities sales (vs. a $116K loss in 2024) and growth in the Unified Mortgage Division .

What Did Management Say About Growth Initiatives?

CEO Scott Everson highlighted several transformative investments currently dilutive to earnings but expected to drive future growth :

Wheeling Banking Center — Grand opening December 9, 2025. Already contributing to loan and deposit growth before official opening. Expected to be a "top performer" within five years .

Unified Mortgage Division — Continuing to scale with additional production staff, generating higher fee income .

Treasury Management — Developing cash management, merchant services, and payments capabilities to grow fee income and low-cost deposits .

Unified Center — New St. Clairsville facility for accounting, IT, and centralized customer support with AI-powered sales routing. Renovation expected complete by end of Q1 2026 .

"With our unwavering focus on growing our Company through investing in its infrastructure, product development and delivery, we strongly believe that these current undertakings... which are dilutive to current financial performance... will provide a pathway to future growth and lead to increasingly higher performance for our Company over the course of the next twelve to twenty-four months." — CFO Randall Greenwood

How Is Credit Quality Holding Up?

Despite economic uncertainty and higher rates pressuring borrowers, credit metrics remained solid :

Nonaccrual loans increased to $2.3M from $0.7M, though the allowance coverage ratio of 188% and below-peer NPA ratio indicate manageable credit risk . Provision expense increased $375K YoY to $674K to build reserves amid loan growth and macroeconomic uncertainty, reducing EPS by approximately $0.054 .

Capital & Shareholder Returns

United Bancorp remains well-capitalized and shareholder-friendly:

The bank paid regular dividends of $0.745 (+5.7% YoY) plus a $0.175 special dividend (+16.7% YoY) .

How Did the Stock React?

UBCP shares closed at $14.19 on earnings day, up 1.1% from the prior close of $14.03, with aftermarket trading reaching $14.33. The stock has gained 10.4% over the past year from $13.00 to $14.35 .

With a market cap of approximately $82M, UBCP trades at 10.7x trailing earnings and 121% of tangible book value .

What Are the Key Risks?

Management flagged several headwinds :

- Trade policy uncertainty — Tariffs announced under the new administration adding to economic uncertainty

- Government shutdown — Longest in U.S. history during Q4 2025 after Congress failed to pass funding legislation

- Slowing employment and lingering inflation concerns

- Competitive pressure in a challenging industry environment

Forward Outlook

Management is optimistic about 2026, citing :

- Continued net interest income expansion from FOMC rate cuts (three cuts in late 2025)

- Extended call protection on municipal securities portfolio benefiting in falling rate environment

- Loan portfolio repricing tailwind continuing

- Growing commercial loan demand, particularly small-business oriented (81% of total loans)

- Goal to grow assets to $1.0 billion threshold ("scale is definitely our friend")

"We are truly excited about our Company's direction and the potential that it brings. With an unwavering focus on continual process improvement, product development and enhanced delivery, we firmly believe the future for our Company is very bright." — CEO Scott Everson

EPS Trend

United Bancorp is a bank holding company headquartered in Martins Ferry, Ohio, operating 19 banking centers across Ohio and West Virginia through its Unified Bank subsidiary .